Market Sentiment

NFTGo collects and visualizes real-time data revolving the NFT market, encompassing both minting and trading activities. The data collected is then used to curate metrics that are able to cater to that of users. Through the analytical metrics provided, users can then gain a comprehensive understanding of the NFT market trends, and optimise their investment or trading decisions.

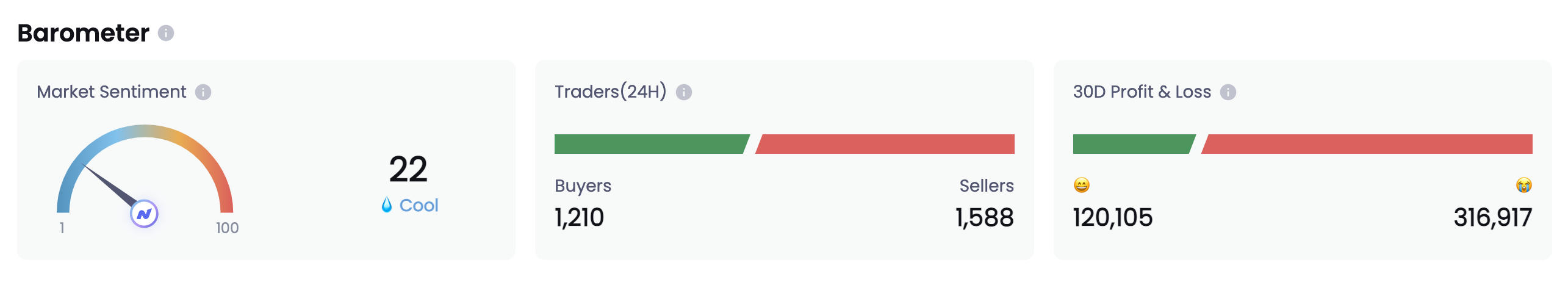

Barometer

The Barometer consists of a few metrics that gives an overview of the current market sentiments towards NFTs.

Barometer | Market Sentiment

The Market Sentiment Index is a number ranging from 1 to 100, which indicates the amount of interest the market has for NFTs.

- 1 < Index < 40: Cold | Low interest

- 40 < Index < 60: Regular | Neutral interest

- 60 < Index <100: Hot | High interest

There are a few factors that are taken into account to determine the market sentiment:

- Floor Price: Taking into account the ETH floor price of the top 100 collections. 70% of this weightage is attributed to blue chips while the remaining 30% is attributed to non blue chip collections

- NFT Trading Volume: The formula used is log(1 + 0.7 (24hr trading volume of blue chip collections) + 0.3 (24hr trading volume of non blue chip collections within the top 100 collections)

- Google Trends

Barometer | Traders (24H)

The number of buyers and sellers within 24 hours is shown, allowing users to have a gauge of the amount of trading activity occurring. A market with higher trading volume could possibly indicate a hot market and thus users are willing to participate in it. Alternatively, it could also be due to certain launches or announcements that have attracted the market's attention.

Barometer | 30D Profit & Loss

The amount of profit and loss made by NFT traders in a timeframe of 30 days is shown.

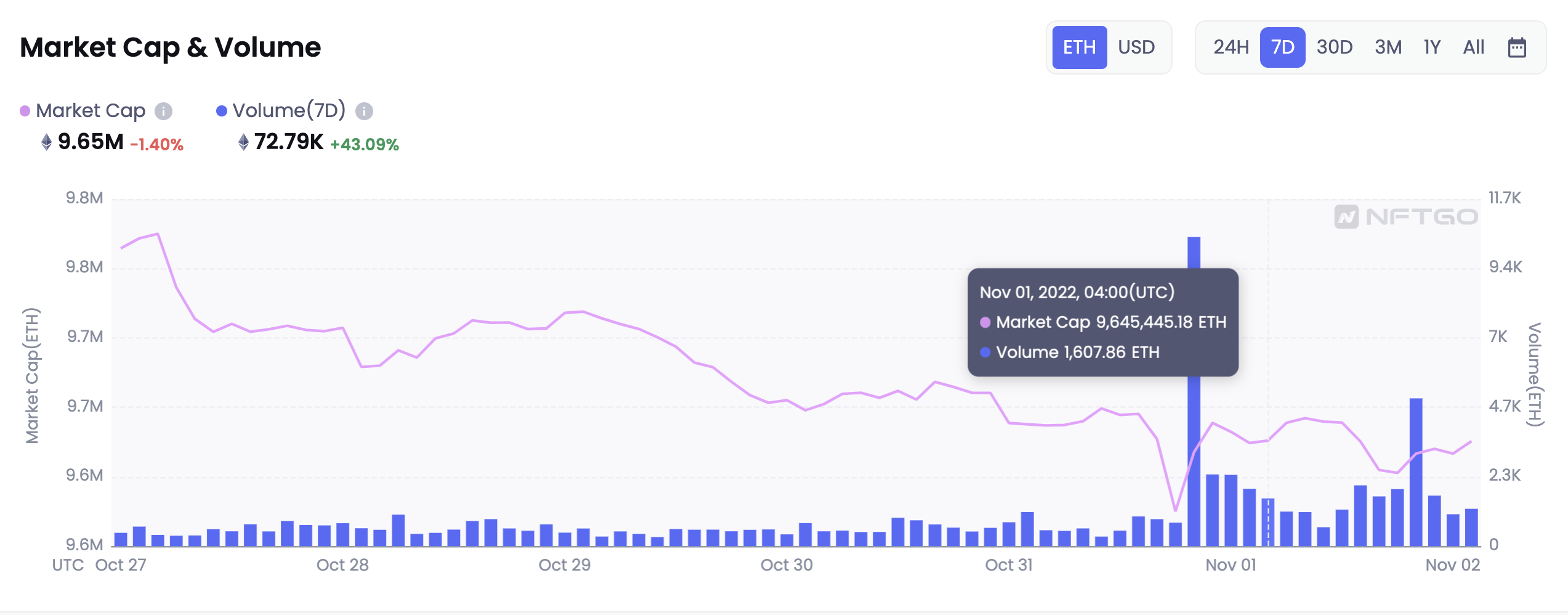

Market Cap & Volume

A very clear reflection of the market's performance would be the market cap and volume. Market cap is essentially a measure of the value of all NFTs within the market. Given that the NFT value is highly dependent on market sentiments, an increasing market cap trend indicates bullish sentiments within the market and vice versa, a declining market cap is reflective of bearish sentiments.

Volume is also a good indicator of whether there is active market participation. A lower trading volume could potentially reflect that traders/investors are sitting out of the market as they foresee a drop in value.

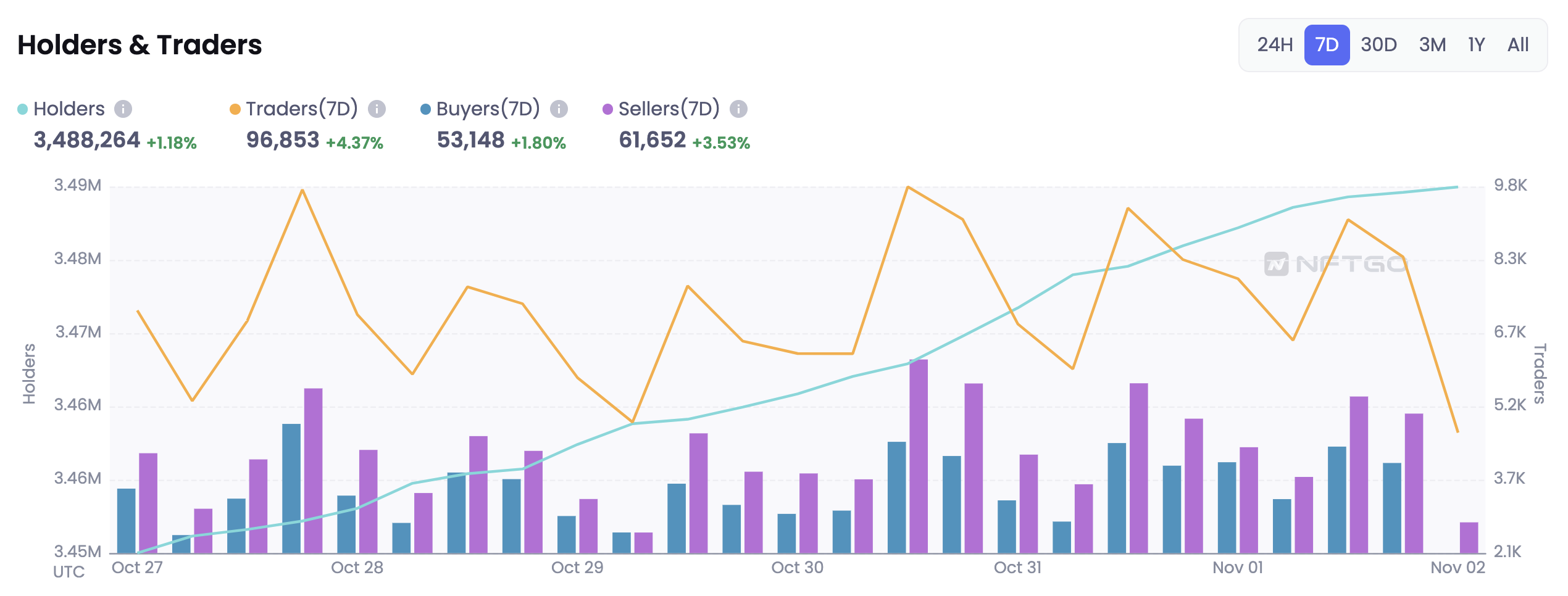

Holders & Traders

Consumer behavior drives industry trends. Hence, it is also interesting to analyze consumer behavior over time, as the historical data could potentially help users identify some short term trends.

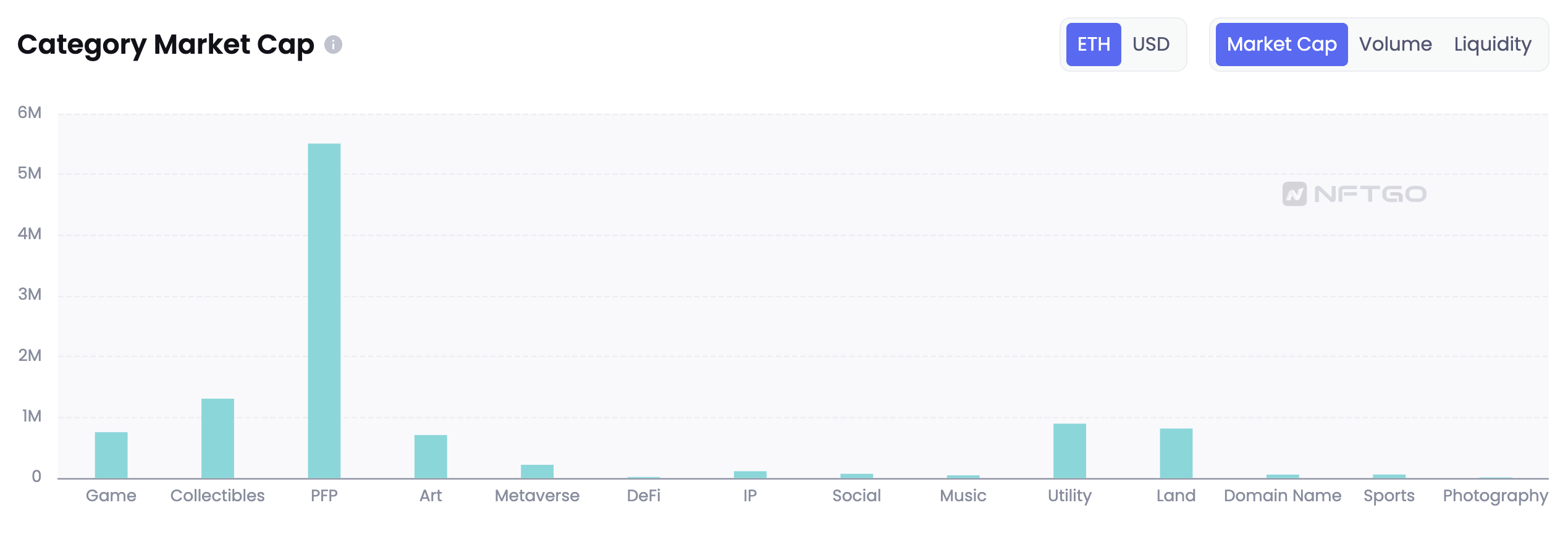

Category Market Cap & Volume

The NFT market is broadly categorised into 14 types: Game, Collectibles, PFP, Art, Metaverse, DeFi, IP, Social, Music, Utility, Land, Domain Name, Sports, Photography. Categories. With this feature, users are able to get a grasp of where bulk of the market value is in.

Category volume highlights the trading volume within each category, based on the desired time period. This is a very good indicator in helping users identify the industry trend. As evident over the past year, trends shift within the NFT marketplace and certain categories of NFTs become the talk of the town during certain periods, this is when the transaction volume within such categories will increase.

Updated 8 months ago